If you’re rich, this is good and noble accounting. If you’re poor, this is tax evasion.

You have to have enough income and deductible expenditures to where your itemized deductions would be greater than the standard deduction of $24K, which will not be the case for the overwhelming majority of people

Even so. Doing well for themselves middle class American: tax evasion. The rich: well they’re just really smart business people and we should worship them!

Since the business finances are separate from the individuals/family they would have to pay the business with their personal funds, basically just paying taxes on all of their income twice.

The rich definitely do not do that

If I were an IRS agent, I’d just hang out on these forums and start sending people catfishing messages.

An IRS agent like you will lose your job on Jan 20

I know, but they’ve had so much time to do it.

There’ll be plenty of work for IRS agents in running punitive audits of people and companies in the Emperor’s disfavour.

Sometimes I give them silly advice. Not anything that would actually cause a problem, but just saying they need to find a certain stamp for the document to be valid or whatever.

The problem is that these people have no way to pay their back taxes except rusted out old trucks and dilapidated huts. Then our billionaire overlords get away with murder even more despite actually having the resources to pay for their shit since it’s another is agent not working the big, difficult case.

That’s simply not true. Most SovCits are not impoverished like that. If they were, they wouldn’t spend thousands of dollars to find the cheat code out of paying child support.

Source.

Well that does fit that petty tyrant attitude.

Getting people to pay the taxes they owe as members of society is so tyrannical, isn’t it? Clearly the non-tyrannical thing would be to let people just get away with being leeches.

Yeah sure,

workworry about your feelings rather then do their actual job. Seems petty and tyrannical to me. Maybe, I dunno collect taxes instead of trolling assholes or something you know… Worthwhile.Still waiting on that ban explanation btw bud.

Since you haven’t taken the hint yet and you are now violating Lemmy ToS and harassing me about something that didn’t even happen in this community: you’re not going to get any more explanation than the one you already got.

Now stop harassing me or I will go to the admin about it.

Removed by mod

which from my research you are in charge of

Oh do show mere where you researched this “fact.” I’d love to see the “evidence” you have from your “research” that I am in charge of c/world.

Removed by mod

you are now violating Lemmy ToS and harassing me

Jesus fucking Christ you’re not being harassed. Go touch some fucking grass, weirdo.

I guess all of their comments were removed and they were banned because of how non-harassing they were.

You see US tax law is so complicated and I know so little about it that I don’t know if this would work or not. I’m guessing somehow not unless you’re rich.

Many business owners that I know do a lite version of this. Going out to eat? Discuss work for 5 minutes, then you can call it a business meeting and avoid paying taxes on the meal. Driving to and from work? Gas is a write off. Buying supplies for the office? Tax free, and maybe some of the supplies make it home with you.

That’s fraud. The 5 minute business discussion can be written off, the remaining (let’s say) 55 minutes cannot. Maybe it differs where you live, but where I do only travel between work destinations can be written off, so home to work doesn’t count. Buying supplies for the office is a normal and valid expense, taking them home is theft and/or taxable

Last I checked in the US, the time wasn’t a factor. You only get to write off 50% though - I think the assumption is that you would have had to feed yourself anyway and the extra 50% is the cost of doing so in a restaurant or for the other party’s meal.

They’re simply talking about what people do and probably usually get away with. I hope no one is reading a comment like that (or yours) on the Internet and then changing how they file their taxes…

Oh yeah, I probably should have specified that it’s not legal, just common practice. Tax fraud ain’t anything to fuck around with.

Yeah if you own a small business, learning what you can write off is crucial. It takes a lot of the pain out.

But you’ve still gotta have an actual business XD

yeah and a business is not allowed to not have revenue for over a certain period of time.

This is like that Seinfeld segment about “writing it off”.

For those not aware, you can typically only write off the taxes you owe to the government, and only in certain situations where that’s allowed.

I know a guy (independent contractor) who formed a 1-man corporation and paid himself out of it as an employee. Saved a ton on taxes.

It’s pretty common to form an LLC for your own, self run business even at one person. The business makes all the money, you pay your “employee” (you) a small amount and you save on taxes. Wife does this, her employee paycheck is like $25k/year.

If you ever have a friend who’s not doing this, tell them to get a good accountant lol

Yeah, this is essentially contracting.

Alongside settling yourself up as a limited company, you also make not only your taxes much simpler to do, but getting shit like indemnity insurance is easy as a company - but very challenging to do as a sole trader.

How does this work if you want to take money out? Like give yourself a bonus that’s taxable? I mean legally.

She gets income from two sources: as an employee (“normal” income), and as a business owner. There’s something called an owner’s draw, which essentially lets you take money from the business for personal use, and it gets taxed as personal income (i.e., normal job income taxes).

This is my loose understanding. We have a CPA for our stuff, and she sorted all this out before we even started dating.

Edit: you can also pay yourself dividends from the business, but this is considered supplemental income and can’t be a majority. These dividends are taxed at a lower rate than your income.

That actually sounds really good 👍 Would need to read how this works across the pond, but hoping fairly similar.

I would highly recommend asking an accountants advice, I assume there are similar services for when you file in the UK. Finding a CPA (Chartered Accountant in the UK) is huge, they’ll generally charge more but they can represent you in the event you get audited (had to look it up and confirm it’s the same for UK). Now if you get audited, they have a vested interest in protecting you. In the US they’re often legally obligated to protect you (and themselves).

Thanks, will take a look at that. Actually got an accountant acquaintance so il pick his brain one day :)

This is so dumb I can’t believe people aren’t getting audited left and right.

A single member LLC is simply you. All the income becomes your income. It doesn’t matter if you pay yourself through a draw or not. If you’re finding ways to get your write offs over the standard deduction without spending a bunch on actual business related expenses, you’re probably doing it wrong and committing tax evasion, plain and simple.

Look into piercing the veil.

There are still benefits to an LLC if you’re alone. Suggesting that everyone is committing tax fraud is speculative at best. Fun fact, she actually was audited for 2017-2019 because of shit her ex husband did, and no tax fraud (on her part, he was definitely guilty and we successfully argued for Innocent Spouse Relief). You can also pay yourself dividends which are taxed at a lower rate, though the IRS checks this income to make sure you aren’t using this stupidly.

Generally, you’re protected with your assets, piercing the veil can only occur if there’s egregious fraud and clearly no separation between yourself and the business. Just keep your business and personal accounts separate and you’ll have the legal protections.

Edit: I went back and asked her and there’s definitely tax benefits, she files as an s corp and it saves a bunch on taxes. It’s more expensive to file so the income must be over like $70k-$80k to really make it worth it.

It doesn’t have to be egregious. I seriously doubt she has legitimate business expenses above $29,200, assuming you’re filing jointly.

Sorry, a bit frustrated as someone who does everything above board but sees all these pavement princess 4x4 lifted trucks running around with commercial bumper stickers who clearly aren’t running a real business.

She does exceed that in cost of goods sold actually, we have whole ass pallets of wood slices in the garage. She makes a $15k order alone every year for Christmas.

If it helps, we don’t deduct anything for our vehicles. We technically could do miles or gas for travel to shows but it’s relatively little.

2017 tax law changed this

One of the law’s changes allowed owners of pass-through businesses—partnerships, sole proprietorships, and S corporations—to deduct 20 percent of their qualified business income (QBI) when calculating their taxes.

Edit: Better source https://www.irs.gov/newsroom/tax-cuts-and-jobs-act-provision-11011-section-199a-qualified-business-income-deduction-faqs

That 20% is not in addition to the standard deduction. It only comes into play if your total deductions exceed the standard deduction.

Correct.

Step 1: Use credit card.

Step 2: Get a loan to pay the credit card off.

Step 3: Get another loan to pay that one off.

Step 4: Get another credit card.

Put the credit cards in different trusts

Write it all off

Hilariously, that does work for a while. The more unused credit you have, the better your credit. You would think having a half dozen credit cards hurts your credit, but nope. It’s the opposite.

Opening them will hurt your credit for a short while, but moving debt from 0% interest card to 0% interest card occasionally will increase your credit. Leaving the old cards open and empty will only make youre credit rating go up. You do not, at all, have to use them to maintain them or increase your credit score.

Eventually you will have to pay, and it’s entirely likely to be the worst time for you as passing the buck with debt tends to lead to building more debt, but it’s possible. Credit is addictive, so they want you to have more of it.

Never trust anyone or anything. Trust me.

What does this even mean? Can someone explain?

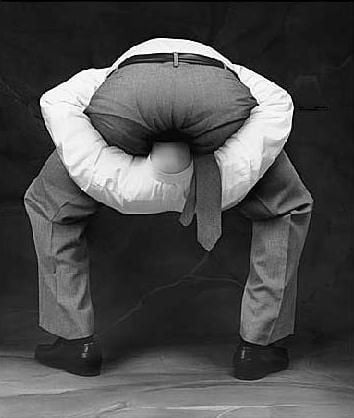

They’re trying to avoid paying taxes by recreating the absurd Hollywood style accounting, but things don’t quite work like that.

My dad’s friend did this for years, bought his kids a home and “rented” it to them. He was able to write off a lot of repairs/renovations and improvements, while they wrote off their rent money, which was just the mortgage payment. There were some other little things that could be done, but by and large it was very advantageous for the whole family (better mortgage rate too), and resulted in huge savings for them. Dad called it the “set your kids up for life” plan.

He wanted to do it for me and my sister but funny thing is you still need the money to buy the second house to get started…

There is also something you can (or could?) do in Canadian tax law where you could set up your mortgage a certain way and basically write off the interest you pay. It has a name but I stopped doing that research awhile ago and can’t recall. It had some sketchy risks and was definitely “kinda” legal. I am not rich enough to afford a lawyer to make it legal for me…

My dad’s friend did this for years, bought his kids a home and “rented” it to them. He was able to write off a lot of repairs/renovations and improvements, while they wrote off their rent money, which was just the mortgage payment.

But then doesn’t he have to pay income taxes on the rent? Where if it stayed his house he couldn’t write off the repairs, but any money he paid for the mortgage is tax-free.

He should have to pay income tax on the rent but he does enough repairs to write that off.

I was never 100% it would work out except for the lower mortgage rate.

Idea stolen from wulrus, but the term is tusk, not trust. Then it work.

I’m financially illiterate so can someone explain to me if…

-

Would this actually work?

-

If so, I much legal trouble can I get in?

Don’t worry, the people posting those sovcit fever dreams are financially (generally?) illiterate too.

It just hit me what sovcit stands for. Damn. I feel like a dumbass.

-

It’s so simple! /s

He doesn’t get to the sovcit arguments for a while, but gets there in the end.

Once had a guy mention i should rent a bunch of cars then rent them out to make money.

Wouldn’t that ruin your credit? “Hell yeah”